5 Steps to Fully Fund an Emergency Fund

𝐈𝐟 𝐲𝐨𝐮 𝐰𝐚𝐧𝐭 𝐭𝐨 𝐥𝐞𝐚𝐫𝐧 𝐦𝐨𝐫𝐞 𝐚𝐛𝐨𝐮𝐭 𝐬𝐚𝐯𝐢𝐧𝐠, 𝐤𝐞𝐞𝐩 𝐫𝐞𝐚𝐝𝐢𝐧𝐠...

What does your savings account look like? Are you prepared for a $1,000 emergency? What would happen if you lost your job tomorrow? Would you have enough saved to meet your basic living expenses for the rest of the month? If not, please keep reading. This is important 👇🏾

Life is unpredictable and we never know what will happen. In my opinion, *before* you start investing, *before* you start thinking about paying off debt, you need to have an emergency fund. I personally focused on this even before starting to focus on paying off my student loans.When I graduated OT school, I made this my top priority. Within 6 months I had fully funded emergency savings account and I felt comfortable moving forward with my financial goals. So, here’s how you can do it, too:

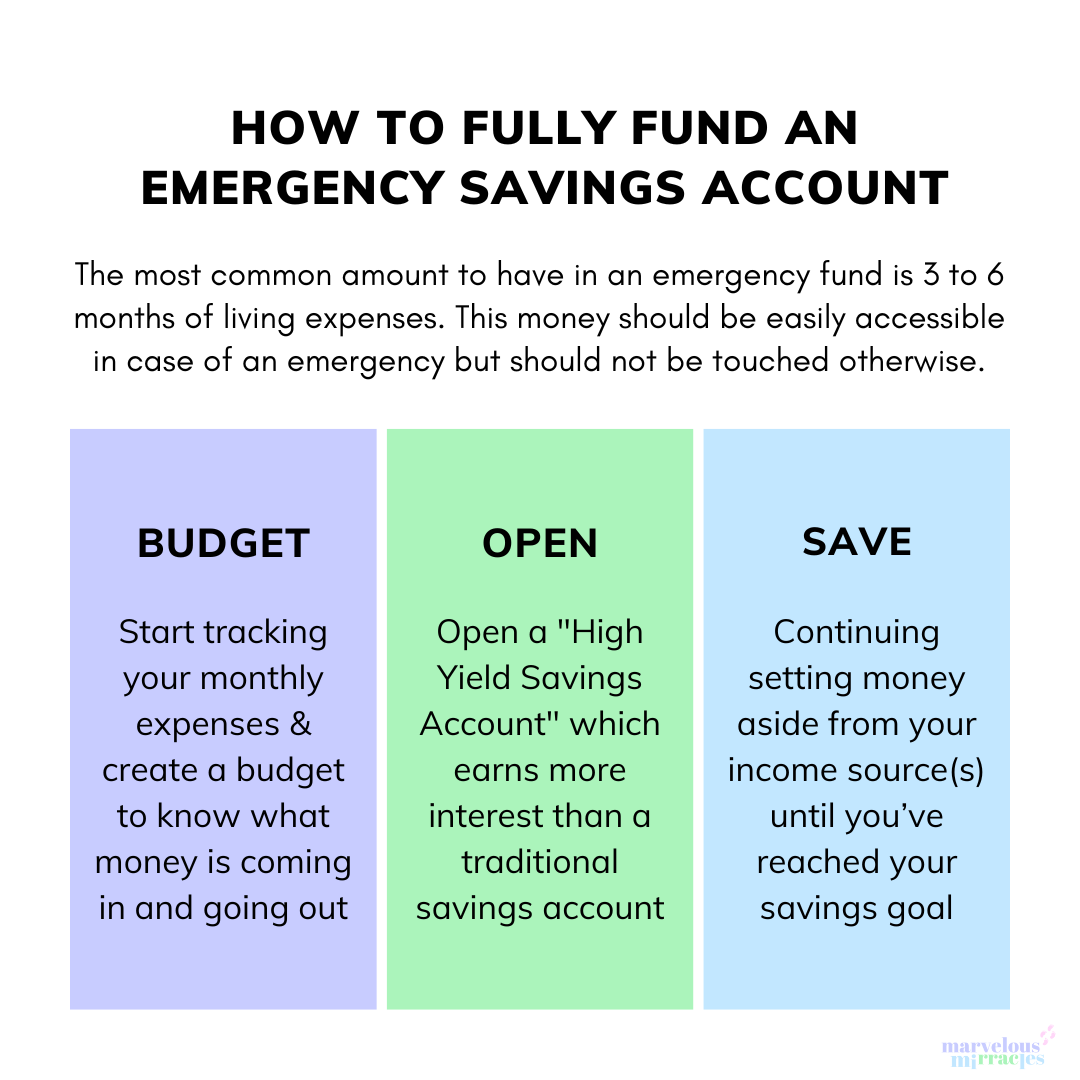

✅ Step One: Create a budget to start tracking your expense

✅ Step Two: Set a specific savings goal (3-6 months of living expenses is most common)

✅ Step Three: Open a high yield savings account (you’ll earn more in interest than a traditional savings account)

✅ Step Four: Continuing setting money aside from your income source(s) until you’ve reached your goal

✅ Step Five: Leave the money there and hopefully you’ll never need to touch it!

I know, finance is scary but you will feel so much more comfortable and confident moving forward knowing that you are covered with your emergency fund. Trust me, peace of mind and financial security is crucial 💚✨

🙋🏾♀️ Need help getting started? 👉🏾 I offer 1:1 consultation & coaching to help you create a plan to feel empowered and confident while tackling and managing your money. Click the link in my bio to learn more and book with me.

💬 𝗪𝗵𝗮𝘁’𝘀 𝘆𝗼𝘂𝗿 𝗯𝗲𝘀𝘁 𝗮𝗱𝘃𝗶𝗰𝗲 𝗳𝗼𝗿 𝘀𝗼𝗺𝗲𝗼𝗻𝗲 𝘄𝗮𝗻𝘁𝗶𝗻𝗴 𝘁𝗼 𝗯𝘂𝗶𝗹𝗱 𝘂𝗽 𝗮 𝗵𝗲𝗮𝗹𝘁𝗵𝘆 𝘀𝗮𝘃𝗶𝗻𝗴𝘀 𝗮𝗰𝗰𝗼𝘂𝗻𝘁?